AI video intelligence built for BFSI Industry.

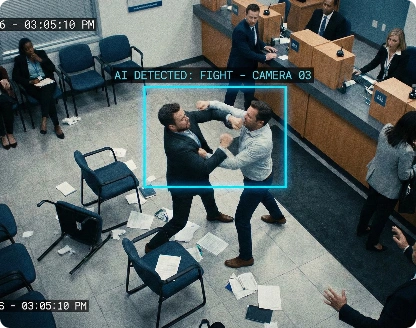

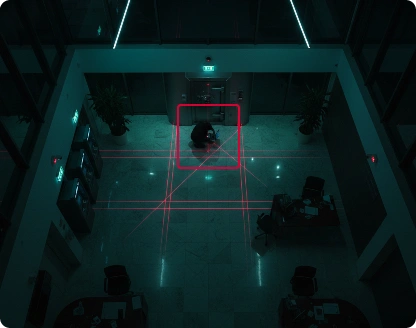

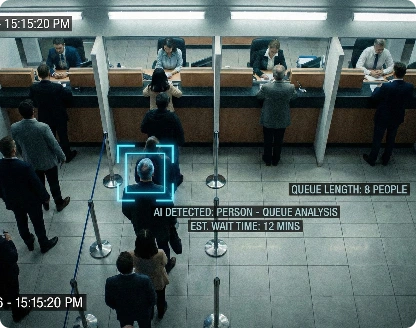

Mikshi AI transforms existing surveillance cameras across BFSI environments into an intelligent monitoring system for security, compliance, fraud detection, and operational oversight.

From ATM monitoring and branch security to vault access control and customer movement analysis, the platform delivers actionable insights using a single, unified solution—without replacing existing infrastructure.